Some Basic Information

Overcoming Tax Challenges in the GCC

Though the GCC is often seen as a low-tax region, its tax frameworks can be complex and challenging to manage. Businesses, especially those lacking in-house tax expertise, face risks such as compliance issues, penalties, and missed opportunities for tax optimization. Our team of experienced tax professionals offers tailored, cost-effective solutions to help businesses navigate local tax laws and optimize tax management.

Key Services

Tax Compliance Support

Ensures businesses meet all local tax obligations, including VAT and corporate tax.

Strategic Tax Optimization

Helps businesses uncover opportunities to reduce tax liabilities.

Expert Guidance

Provides in-depth insights for making well-informed tax decisions.

Tailored Solutions

Customized services to meet the specific tax needs of your business.

Managing Tax In GCC

Managing Diverse Tax Obligations in GCC

Navigating GCC’s Tax Landscape -

GCC imposes several taxes, including VAT, Income tax, Withholding tax and Excise duties, which can significantly affect business transactions and operational costs. Without strategic tax planning, companies may face higher taxes and compliance challenges.

Compliance Challenges -

Each tax type in GCC has specific regulations, making it difficult for businesses to manage their obligations. Failure to comply with these requirements can lead to severe penalties and financial strain.

Our Expertise

SRQ's Expertise in GCC’s Tax Landscape

SRQ Companies offers expert guidance to help businesses in GCC navigate the complex and evolving tax

landscape. Our team provides tailored tax strategies, enabling businesses to make informed decisions

and effectively manage their tax obligations.

With a focus on reducing compliance burdens, SRQ’s chartered accountants offer oversight of tax

legislation, ensuring seamless transitions and full adherence to regulations while minimizing

compliance costs and operational challenges.

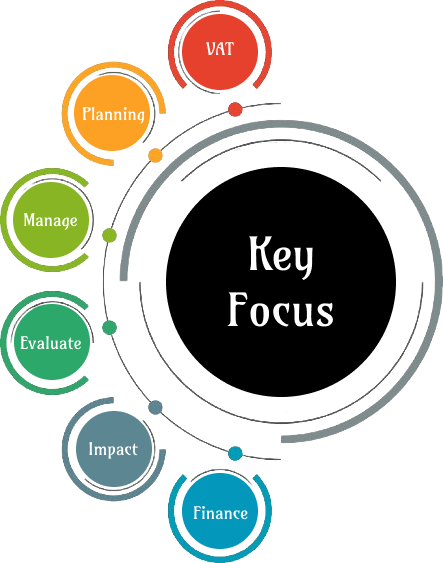

Key Frame

Our Key Focus Areas